The Student-Run Private Equity & Venture Capital Club at the University of St.Gallen

The club in numbers

Our mission is to create a dynamic platform facilitating robust exchanges between HSG students and top industry professionals across the DACH region. The Private Equity and Venture Capital Club (PEVC Club) is an official club at the University of St.Gallen (HSG) that focuses on increasing awareness and knowledge of Private Equity and Venture Capital on campus.

We provide a platform for exchange among professionals, academics, experienced students, and newcomers. Members benefit from events, workshops, social gatherings, and our PEVC Podcast and Newsletter publications.

Events yearly

Members

Industry Partners

Partners

The PEVC Club maintains corporate and educational partnerships to provide its members with interesting workshops, job opportunities, and helpful study materials.

The partnership serves the establishment of healthy long-term relationships with players from the private equity and venture capital industry.

See below for an overview over our current partnerships.The PEVC Club establishes corporate and educational partnerships to offer members workshops, job opportunities, and study materials. Established in 2021, the partnership program aims to build long-term relationships with players in the private equity and venture capital industry. Below is an overview of our current partnerships.

Main

Partners

Preferred

Partners

Partners

Recruiting

Partners

Academic

Partners

PEVC Days

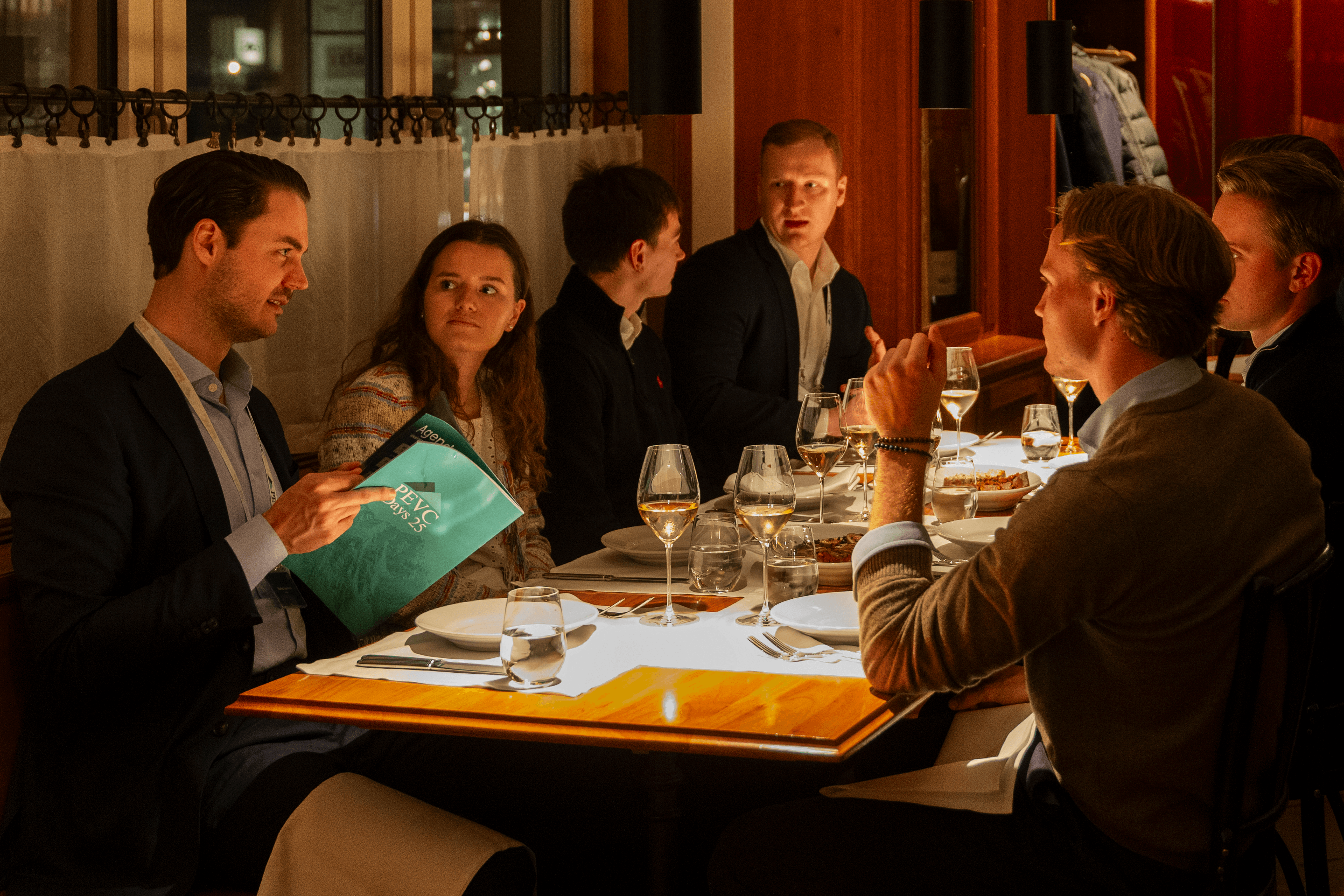

Join exclusive events at the University of St.Gallen! From workshops to dinners, connect with leading PE & VC funds. Save the date: March 09-12, 2026, for unique networking and insights.

What?

Numerous Events ranging from Workshops to Dinners with leading PE&VC-Funds

Where?

University of St.Gallen

When?

Once a year; in 2026 from March 09–12th

Events

Opportunities

Investment Intern @Fortino Capital

Fortino Capital is a leading European investor focused on B2B software. For more than ten years, we’ve been partnering with founders to help build and scale strong software businesses. With ~€1.5bn in committed capital, we’ve invested in 23 B2B software companies since 2013. In the past three years, we’ve also expanded our footprint in Germany, acquiring four software companies in the small- and mid-market segment.

Private Equity Internship @ Ufenau

The Ufenau team invests in companies in the service sector and develops them further through a clear acquisition strategy. We accompany the management on their path of corporate development at eye level with our operational business know-how and experience from the investment sector. Personal commitment, empathy and our passion for SMEs and their people are essential factors for our success. And that is exactly why we are looking for you as an important pillar for our growth.

Capital Markets Investment Professional – Intern @ Vicenda

Vicenda is a partner managed capital markets investor and advisor, specializing in Private Markets. Vicenda’s team brings together experts with complementary backgrounds across the areas of finance, law, tax, and structuring. We offer tailor-made capital markets and financing solutions across equity and debt, as well as attractive investment opportunities. Transactions are sourced, arranged, structured, and placed by Vicenda. Since it was founded in 2013, Vicenda has developed financing solutions for small and medium sized enterprises.

Board

Advisory Board

Stefan, a PhD in Finance from the University of St.Gallen, is a member of its School of Finance. Previously, he worked in the financial services industry for a European bank. He frequently speaks at international finance conferences and contributes to executive education programs. Additionally, he holds an affiliated academic position at Singapore Management University.

Roberto studied mechanical engineering at the Technical University of Aachen, graduating in 1984, and earned a PhD in Business from the University of St. Gallen in 1989. A Dutch/Italian citizen, he teaches at St. Gallen and serves on the board of Swiss Private Equity and Corporate Finance Association. From 1989 to 1997, he was a consultant at McKinsey & Co. and later served on the European Venture Capital Association board (2003–2007).

Frank Becker joined Invision in 2000, focusing on investments in education, IT, and innovative service businesses. He oversees investments in Cygna Labs and Vista Alpina, serving on their boards. Previously, he managed investments in Vantage Education (sold 2020), Swiss Education Group (sold 2018), Kraft & Bauer (sold 2018), and RSD (sold 2016). Before Invision, he was CFO of Compaq Computer Switzerland and worked at Boston Consulting Group. He holds an MBA from Stanford and a degree in electrical engineering from ETH Zurich.

Lifetime Access to Exclusive Opportunities!

Interested in joining the PEVC Club?

Get your lifetime membership for CHF 50 and gain access to events, job postings, study materials, and more.

Discover the benefits in detail and apply via the button below!

a 4-day conference with over 40 events, featuring more than 30 leading industry partners

a 1:1 mentoring program with Investment Professionals from various PEVC Partner funds

company visits and international trips